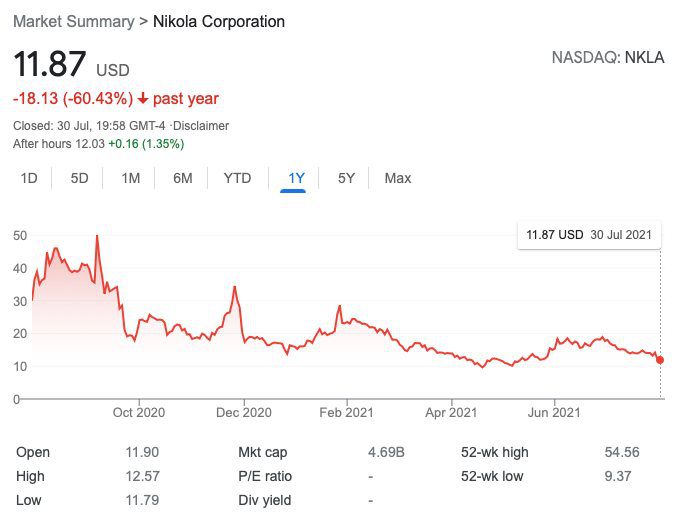

Last September a report from activist short-seller Hindenburg Research alleged that statements made by Trevor Milton, the founder of the electric and fuel-cell truck upstart Nikola Motor Company, were misleading its investors.

One of the allegations was that a video of a Nikola truck on the freeway was in fact a Nikola truck with no powerplant gliding down hill powered entirely by gravity. Read about the allegations at EVINFO.

That report led to the resignation of Milton, who still owns about 20% of the company that remains worth roughly $1 billion. But now it’s time for Milton to face some consequences, perhaps: On Thursday the U.S. government filed criminal charges against Milton, and the Securities and Exchange Commission filed a civil complaint.

According to the AP, Milton reportedly posted his $100 million bail with two Utah properties. The criminal case, which was filed in the U.S. District Court in New York Thursday, includes charges of securities fraud and wire fraud, and only sums up Milton’s alleged misstatements from November 2019 through September 2020, a time when Milton led the company and including its SPAC maneuver to becoming publicly traded.

Nikola had a business plan that sounded strong but was far-fetched in the details. It would build battery-electric and fuel-cell semi trucks and other commercial trucks, and it would build out a supporting network of fuel-cell infrastructure, with fueling wrapped into the leases of its trucks.

Badger Pickup

The trucks, later including a pickup called the Badger, would mostly be built from the “ground up”—a phrase frequently used by Milton—by Nikola, with the company’s supposed energy expertise and economies of scale helping bring hydrogen costs down.

Nikola Badger

“Trevor Milton, the defendant, engaged in a scheme to defraud investors by inducing them to purchase shares of Nikola Corporation [‘Nikola’], the electric- and hydrogen-powered vehicle and energy company that Milton founded, through false and misleading statements regarding Nikola’s product and technology development,” the indictment reads.

The indictment also alleges “false and misleading statements that Nikola had engineered and built an electric- and hydrogen-powered pickup truck known as “the Badger” from the “ground up” using Nikola’s parts and technology, when Milton knew this was not true.”

The document alleges that the Badger, which claimed to combine hydrogen fuel-cell and battery electric powertrains, was essentially a “show truck”—not even a prototype—based on an F-150 “donor” truck and modified with third-party components.

“Milton also boosted interest in the Badger and gave the misleading impression that the Badger was far along in development with additional deceptive statements, including that Nikola would start taking reservations on the truck, that certain reservation packages were sold out, and that the truck had particular capabilities or technical features.”

“No one at the OEM Partner ever saw the Badger prototypes that Nikola had been working on and they were not part of the OEM Partner’s engineering or development plans.”

Pipe dream

Furthermore, the document alleges false statements surrounding claims that Nikola was producing hydrogen.

Going back to 2016, Nikola claimed to be basing its business model around hydrogen distribution and a national hydrogen network that would be able to refuel its fuel-cell trucks. But the indictment document claims that “Nikola had never obtained a permit for, let alone constructed, a hydrogen production station, nor had it produced any hydrogen,” and noted that at the single station it completed at its headquarters in April 2019, the hydrogen was hauled in from an outside vendor and the station wasn’t built for Phoenix temperatures.

Milton also made claims that the company was producing hydrogen at below $4 per kilogram in March 2020, when it hadn’t produced any hydrogen at all and had no agreement for electricity supply to make that claim feasible. And according to the suit, he misrepresented the technology it planned to use for the One, Two, and Tre vehicles, and repeatedly claimed that it was also developing parts for those trucks in house.

“As a result, some of the retail investors that Milton’s fraudulent scheme targeted suffered tens and even hundreds of thousands of dollars in losses, including, in certain cases, the loss of their retirement savings or funds that they had borrowed to invest in Nikola,” the suit alleges.

“Unlike an IPO, a SPAC transaction is not subject to a quiet period. Therefore, unlike when shares are first issued through an IPO, when a private company becomes publicly traded through a merger with a SPAC, its executives are not limited in their ability to speak publicly about the business of the company.”

GM agreed to a strategic partnership with Nikola in September of 2020—just before the short-seller’s report—in which GM would supply Hydrotec fuel-cell systems for Nikola’s Class 7 and 8 semis, battery modules for other Nikola trucks, and Ultium battery technology and a lot more for the Badger pickup.

Under that deal, GM was due to take an 11% stake in Nikola—worth about $2 billion when the deal was announced—and get up to $700 million for building the Badger. But the deal was never finalized and, with demoted memorandum of understanding language announced in November, giving Nikola “cost plus” access to GM fuel-cell components with payment up front, it appeared the Detroit automaker did its due diligence after the fact.

No future

It’s worth noting that Nikola continues on a more cautious-sounding version of its business plan—without Milton. The company announced a partnership with TravelCenters of America to build its first two hydrogen stations by early 2023; it bought a 20% stake in an Indiana facility that can help supply hydrogen; and it aims to deliver its first Tre battery electric trucks late this year.

That said, the shadow and potential depth of the allegations hang over the company. If true, and there was nothing that its board or other officers did to contain such fraud, there may well be accomplices. It’s reasonable to suspect that after the spotlight fades from Milton, the company itself will soon be feeling the burden of so many unfulfilled promises.

Short

Sell the shares. Take a short position. We purchased Puts after the Hindenburg Research publication and watched the stock fall.

The company still has a valuation of close to $5B. We expect this to go to zero.