It has been a busy time for the EV markets with sales ramping as customers continue to embrace electric cars and as manufactures are falling over themselves to show how Green they have become and launch new Plug in models. – Even Lexus has joined the fun with a pure EV, the UX 300e.

EV Headlines

- Global electric car sales for June 2021 were up 153% YoY reaching 8.7% share.

- Europe sales rose 157% YoY reaching 19% share.

- China sales rose 158% YoY reaching 15% share.

EV market news

- EU proposes end to the internal combustion engine in 2035.

- Bank of America sees EVs representing 67% of total car market share by 2030.

- Mercedes all-electric by 2030.

- Stellantis 30b euro wager on EV market through 2025.

- Hyundai aims to triple EV sales by 2025.

- Mercedes plans to go all-electric by 2030, plans for eight Gigafactories.

- Great Wall Motor plans to sell 3.2 million EVs in 2025.

EV company news

Tesla Q2 $1b net income.

EV Overview

Another record EV Sales month for June as electric car sales represented an impressive 8.7% market share (see below). Electric car sales for June 2021 saw staggering results in both Europe (237,000) and China (235,000) as they race neck and neck for the EV lead. The EV disruption is rapidly growing with Europe June 2021 market share at 19% (last year June was 8.2%) and China June 2021 market share at 15% (last year June was 5.5%). These results are roughly a 2.6x (158%) YoY increase based on the raw numbers. Now that’s exponential growth and disruption!

An interesting new fact for the month was that “auto companies collectively are spending $330 billion over the next five years to bring more plug-in models to showrooms” (see EV market news). This just further highlights the rapid shift to EVs.

Finally, released in July, in the BloombergNEF’s New Energy Outlook 2021, BNEF forecast “to reach net-zero” by 2050 we need to produce 11x more EVs per year by 2030 (than 2020) and 26x more batteries pa by 2030 (than 2020). So while the EV disruption has clearly begun, you can see by these forecasts we are really just at the beginning.

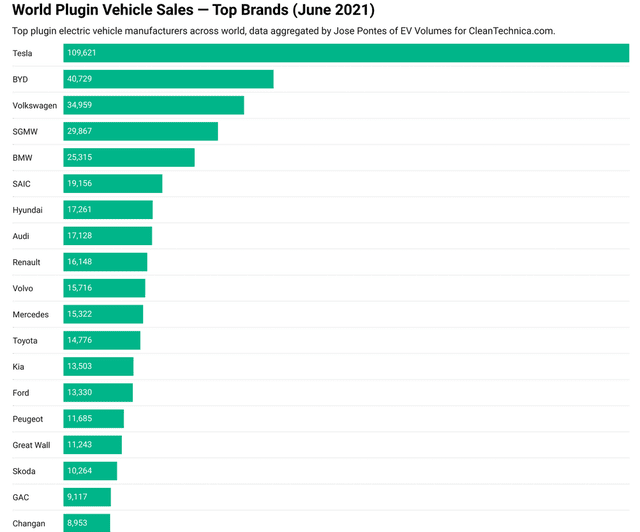

Global electric car sales as of end June 2021

Global electric car sales finished June 2021 with 583,000 sales for the month, up 153% on June 2020, with a market share of 8.7% for June 2021, and 6.3% YTD.

Note 70% of all global electric car sales in 2021 were 100% battery electric vehicles [BEVs], the balance being hybrids.

China electric car sales were 235,000 in June 2021 (best month ever), up 158% on June 2020. Electric car market share in China for June was 15.0%, and 11% YTD. Reuters reported in Nov. 2020 China has a 20% NEVs target for 2025. A Sept. 2020 report from Bloomberg Green stated: “China’s updated NEV target for 2025 is 15% to 25%. For 2035 the NEV target will be 50% to 60%.”

Europe electric car sales were 237,000 in June 2021 (2nd best month ever), up 157% on June 2020. Europe electric car market share was 19% in June, and 16% YTD. Germany sits at 24% share in June and 23% YTD. Electric car market share YTD for Switzerland is at 40%.

US electric car sales were not available; however InsideEVs reported in July: “In trend-setting California, electrified vehicles reached a 20% share of the market in the first quarter of 2021.”

Note: The above sales include light commercial vehicles.

Note: An acknowledgement to Jose Pontes and the team at CleanTechnica Sales for their work compiling all the electric car sales quoted above and below.

Source: CleanTechnica

EV company news

Tesla Inc

Tesla is currently ranked the number 1 globally with 15% global market share. Tesla is number 3 in China with 12% market share. Tesla is ranked about 6th in Europe with 7% market share. Tesla is still assumed to be the number 1 electric car seller in the US by far.

On July 2, Tesla reported:

Tesla Q2 2021 vehicle production & deliveries. In the second quarter, we produced and delivered over 200,000 vehicles. Our teams have done an outstanding job navigating through global supply chain and logistics challenges.

Tesla EPS beats by $0.47, beats on revenue. Q2 Non-GAAP EPS of $1.45 beats by $0.47; GAAP EPS of $1.02 beats by $0.47. Revenue of $11.96B (+98.0% Y/Y) beats by $560M. Automotive gross margin of 28.4% vs. +26.06% consensus. Capital expenditure of $1.5B vs. $1.19B.

On July 3, Tesmanian reported:

Tesla to deliver around 900,000 cars in 2021, says Loup Ventures. Tesla has demonstrated excellent production and delivery performance in Q2 2021. Having increased their number by 122% compared to the same period a year earlier, the company confirmed that its development and acceleration of delivery growth continues….In their opinion, the company appears to be in the slope portion of its growth S-curve and the reason for this is a “combination of consumer willingness to purchase EVs, along with Tesla’s winning formula of vehicle performance and value.” Tesla delivered 201,250 vehicles in Q2, a record for the company. Most importantly, this reflects a 122% y/y rise.

On July 8, Tesmanian reported: “Tesla Giga Shanghai sold 33,155 cars in June, achieving 400K annual production capacity.”

On July 11, Tesmanian reported: “Tesla Giga Berlin Expected to receive final environmental building permit in Q4, per Brandenburg Minister of Economics.”

On July 20 Electrek reported:

Tesla Semi electric truck is finally about to go into production…..When launching Tesla Semi in 2017, the automaker said that the electric truck’s production versions, a class 8 truck with an 80,000-lb capacity, will have 300-mile and 500-mile range options for $150,000 and $180,000, respectively. It would also have the lowest cost of operation of any semi-truck, making it extremely disruptive in an industry where every cent counts….

On July 23, Tesmanian reported: “Tesla plans to redeem its $1.8B of 5.3% bonds earlier than expected.”

On July 23, Tesmanian reported: “Tesla secures nickel supply deal with Australian BHP.”

Volkswagen Group is currently ranked the number 2 top-selling global electric car manufacturer with 13% market share YTD, and 1st in Europe with 25% market share. Audi is ranked about the number 9 top-selling global electric car manufacturer.

On July 7, Volkswagen reported: “Cross-industry CEO alliance backs EU plan to cut carbon emissions by 55% by 2030.”

On July 13, Volkswagen reported: “Enel X and Volkswagen team up for electric mobility in Italy.”

On July 13, Volkswagen reported: “Volkswagen Group and Gotion High-Tech team up to industrialize battery cell production in Germany.”

On July 20, Volkswagen reported: “Volkswagen Group more than doubles deliveries of all-electric vehicles in first half year.” Highlights include:

- “Major model offensive for battery-electric vehicles [BEV] is having an effect.

- Worldwide BEV deliveries more than double to 170,939 (64,462) units in first half year.

- BEV ramp-up to further accelerate in second half thanks to extended model range.

- Plug-in hybrid [PHEV] also in considerable demand; deliveries more than triple to 171,300 (56,303) units…..”

SAIC is global number 3 with 11% market share. SAIC is number 4 in China (not counting SGMW) with 7% market share. SGMW (SAIC-GM-Wuling Automobile) is number 1 in China with 18% market share.

On July 20, SAIC reported:

SAIC Motor targets selling 550,000 vehicles overseas this year. Chinese carmaker SAIC Motor has set its overseas sales target for this year at 550,000 vehicles. The figure is expected to hit 1.5 million by 2025.

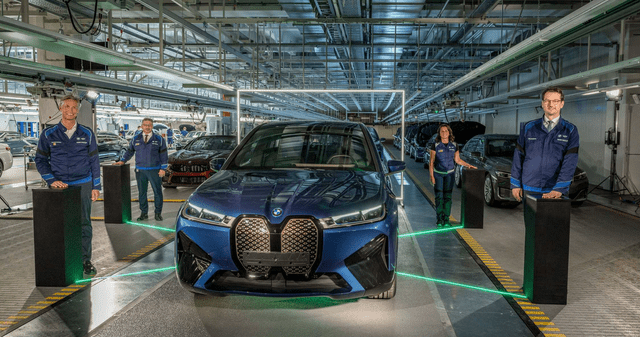

BMW Group is currently ranked the equal number 4 global electric car manufacturer with about 5% (not updated) global market share. BMW is ranked 4th in Europe with 11% market share.

On July 2, BMW Group reported: “Series production of BMW iX* gets underway at Plant Dingolfing…..Standard production of the fully-electric BMW iX* began today in Dingolfing. The plant in Lower Bavaria now produces vehicles with all drive train variants….”

On July 7, BMW Group reported: “BMW Group posts strong sales for first half-year. On course for solid, profitable sales growth in 2021.” Highlights include:

- “BMW Group sales +39.1 percent higher year-on-year; 1,339,080 vehicles sold in first six months.

- Sales up +7.1 percent from pre-crisis year 2019.

- Sales increase for all brands and regions.

- Deliveries of electrified vehicles more than doubled (153,267 vehicles, +148.5%).

- Pieter Nota: “Strong sales for first half-year – continuing on growth track with decisive expansion of electrification”.”

On July 8, BMW Group reported: “Antitrust investigation against automotive manufacturers: European Commission drops most charges against BMW Group.”

Stellantis – merger Fiat Chrysler Group and the Peugeot Group

Stellantis Group is currently ranked the equal number 4 in the global electric car manufacturer’s sales with about 5% (not updated) global market share. Stellantis is ranked 2nd in Europe with 14% market share.

On July 6, Stellantis N.V. announced: “Ellesmere Port in the UK will support sustainable mobility through the production of an all-electric vehicle, starting in 2022.” Highlights include:

- “…..Stellantis £100 million investment supported by the UK government to secure an all-electric future for the plant.

- Ambition for Ellesmere Port plant to be carbon neutral by mid-decade.

- Ellesmere Port to support Stellantis Europe’s leading LCV position.

- Vauxhall continuing its tradition of manufacturing vehicles in the UK, which started in 1903.”

On July 8, Stellantis N.V. announced: “Stellantis to hold “EV Day 2021” today and provides update on H1 2021 trading performance.”

On July 8, Stellantis N.V. announced: “Stellantis intensifies electrification while targeting sustainable double-digit adjusted operating income margins in the mid-term.” Highlights include:

- “Plans to invest more than €30 billion through 2025 in electrification and software, while continuing to be the automotive efficiency frontrunner, with investment efficiency 30 percent better than industry average.

- Targeting over 70 percent of sales in Europe and over 40 percent in the United States to be low emission vehicle [LEV] by 2030.

- All 14 brands committed to offering best-in-class fully electrified solutions.

- Delivering BEVs that meet demands of customers, with ranges of 500-800 km/300-500 miles and class-leading fast charging capability of 32 km/20 miles per minute.

- Four flexible BEV-by-design platforms, scalable family of three electric drive modules and standardized battery packs to cover all brands and segments.

- Platforms designed for long life via software and hardware upgrades.

- Global EV battery sourcing strategy of over 260GWh by 2030, supported by five “gigafactories” between Europe and North America.

- Plans include dual battery chemistries: a high energy-density option and a nickel cobalt-free alternative by 2024.

- Solid state battery technology introduction planned in 2026.”

Renault Nissan Mitsubishi alliance

Renault is currently ranked about number 10 in the global electric car manufacturer’s sales ranking with about 2% market share.

On July 1, Nissan Motor Corporation reported:

Nissan unveils EV36Zero – a £1bn Electric Vehicle Hub. Nissan EV36Zero will supercharge the company’s drive to carbon neutrality and establish a new 360-degree solution for zero-emission motoring.

On July 2, Benchmark Mineral Intelligence reported: “Nissan & Envision AESC to spearhead UK lithium ion economy with 25 GWh battery gigafactory.”

On July 16, Renault Group reported: “Worldwide sales results 1st half 2021.” Highlights include:

- “Renault Group’s worldwide sales are up 18.7% in the first half of 2021 compared with 2020.

- Renault Group confirms the continuation of a selective sales policy favouring growth in profitable volumes……

- The Group’s order backlog in Europe at the end of June 2021 amounts to 2.5 months’ sales, supported by the attractiveness of the Renault E-TECH offering, light commercial vehicles, New Dacia Sandero and Dacia Spring 100% electric.

- The Group is on track to meet its CAFE targets in 2021.”

On July 28, Nissan Motor Corporation reported: “FY2021 1st quarter financial results.” Highlights include:

- “Net revenues of 2,008.2 billion yen.

- Operating income of 75.7 billion yen.

- Net income attributable to owners of parent of 114.5 billion yen.”

Ford is currently ranked about number 16 in the global electric car manufacturer’s sales ranking.

On July 7, Ford reported: “Fully-electrified line-up showcases thrilling Ford driving experiences at Goodwood Festival of Speed.” Highlights include:

- “Ford prepares to dial up acclaimed fun-to-drive attitude as the automaker transitions to 100 per cent all-electric passenger vehicle powertrains by 2030…..

- First all-electrified Ford line-up on display at Goodwood includes Mustang Mach-E GT, Team Fordzilla P1, Mustang Mach‑E 1400 and exciting motorsport news.”

On a related note. Ford UK re spending huge sums on marketing the new Mach-e with TV, Radio, on-line and print adverts. is – we completed the online form on the Ford website to arrange a test drive of a Mach-E EV car.

And the response from Ford and the local dealer has been startling. No call, no relevant email, no text. It is as if Ford don’t want potential customers to see or drive the Mach-e. Crazy when spending so much on marketing. The only good news if that I did receive an invitation to test drive a van for 24 hours. Thanks Ford – close but no cigar.

NIO

On July Bloomberg reported: “Nio plans to add 3,700 battery stations by 2025 in world’s largest auto market.”

On July 1, NIO Inc. reported: “NIO Inc. provides June and second quarter 2021 delivery update.” Highlights include:

- “NIO delivered 8,083 vehicles in June 2021, increasing by 116.1% year-over-year.

- NIO delivered 21,896 vehicles in the three months ended June 2021, increasing by 111.9% year-over-year.

- Cumulative deliveries of the ES8, ES6 and EC6 as of June 30, 2021 reached 117,597.”

Investing

Long :Tesla (TSLA) and Nio (NIO)

Short: Nikola (NKLA)

Sources

The manufactures and Seeking Alpha and especially Matt Bohlsen