Tesla announced Q3 numbers after the bell Oct 18th.

The market not impressed and Musk makes long rambling answers to question on the earning call Q&A.

Highlights:

Revenue

Total revenue grew 9% YoY in Q3 to $23.4B. YoY, revenue was impacted by the following items:

+ growth in vehicle deliveries

+ growth in other parts of the business

– reduced average selling price (ASP) YoY (excluding FX impact)

Profitability

Our operating income decreased YoY to $1.8B in Q3, resulting in a 7.6% operating margin. YoY, operating income was

primarily impacted by the following items:

– reduced ASP due to pricing and mix

– increase in operating expenses driven by Cybertruck, AI and other R&D projects

– cost of production ramp and idle cost related to factory upgrades

– negative FX impact

+ growth in vehicle deliveries (despite the margin headwind from underutilization from new factories)

+ lower cost per vehicle and IRA credit benefit

+ gross profit growth in Energy Generation and Storage as well as Services and Other

+ growth in regulatory credit sales

Cash

Quarter-end cash, cash equivalents and investments increased sequentially by $3.0B to $26.1B in Q3, driven by financing

activities of $2.3B and free cash flow of $0.8B.

Production Q3 and YoY change

Model S/X production 13,688 -31%

Model 3/Y production 416,800 20%

Total production 430,488 18%

Total Deliveries: 435,059 cars – 27% YoY growth.

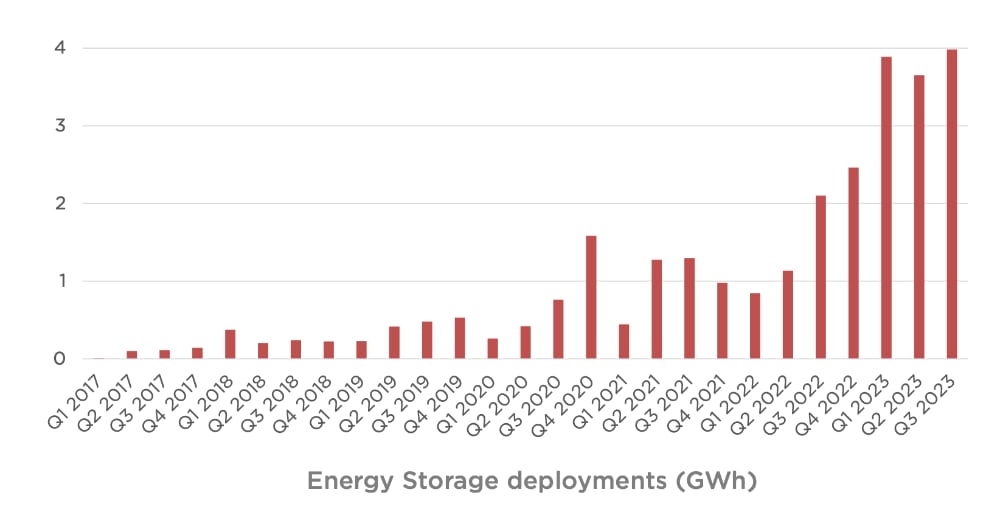

Storage deployed in MWh

Q3 deployments: 3,980 representing 90% YoY growth.

Capacity

During the quarter we brought down several production lines for upgrades at

various factories, which led to a sequential decline in production volumes. We made

further progress smoothing out the delivery rate across the quarter, with September

accounting for ~40% of Q3 deliveries this year, compared to September accounting

for ~65% of Q3 deliveries in 2022.

US: California, Nevada and Texas

At Gigafactory Texas, we began pilot production of the Cybertruck, which remains

on track for initial deliveries this year. We are expecting the Model Y production rate

in Texas to grow very gradually from its current level as we ramp additional supply

chain needs in a cost-efficient manner. Production of our higher density 4680 cell is

progressing as planned, and we continue building capacity for cathode production

and lithium refining in the U.S.

China: Shanghai

Other than scheduled downtime in Q3, our Shanghai factory has been successfully

running near full capacity for several quarters, and we do not expect a meaningful

increase in weekly production run rate. Giga Shanghai remains our main export hub.

Europe: Berlin-Brandenburg

Model Y remained the best-selling vehicle of any kind in Europe year-to-date (based

on the latest available data as of August). Similar to Texas, further production ramp

of Model Y will be gradual.

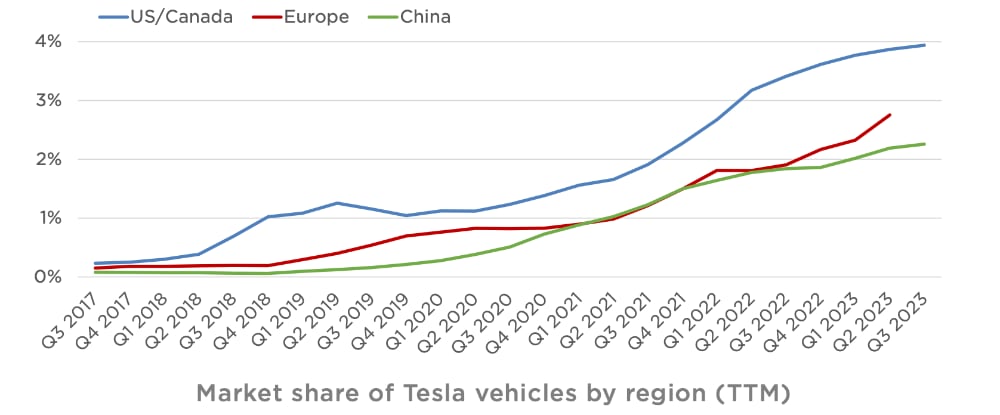

Market Share

With around 3% market share the comply has plenty of room to grow.

Batteries

Company is making good progress on the transition to larger, higher density batteries for both cars and storage.

Energy storage deployments increased by 90% YoY in Q3 to 4.0 GWh, our highest

quarterly deployment ever. Continued growth in deployments was driven by the

ongoing ramp of our Megafactory in Lathrop, CA toward full capacity of 40 GWh with

the phase two expansion. Production rate improved further sequentially in Q3.

Outlook

We are planning to grow production as quickly as possible in alignment with the 50% CAGR target we began guiding to

in early 2021. In some years we may grow faster and some we may grow slower, depending on a number of factors. For

2023, we expect to remain ahead of the long-term 50% CAGR with around 1.8 million vehicles for the year.

During the last 4 quarters Tesla delivered 1,729,000 cars.

Q4 405,278

Q1 422,875

Q2 466,140

Q3 435,059

Total: 1,729,000

To grow sales at 50% would be a huge undertaking even allowing for Cybertruck introduction.

Cybertruck

On the earnings Elon Musk warned of difficulties in ramping up production of the much-awaited Cybertruck electric pickup truck and announced that deliveries would begin on Nov. 30.

The company has said it had the capacity to make more than 125,000 Cybertrucks annually, with Musk adding there was the potential for that to lift to 250,000 in 2025.

More than 1 million people had reserved the truck, he said, which involves placing a small deposit.

All data from Tesla IR and current release: See Tesla Investors