Fewer and fewer ICE-powered cars will be sold in the coming years.

After speaking to specialists from the auto industry, The Financial Times published a comprehensive report about the fossil-burning engine. Interestingly, several experts told the publication sales of ICE-powered vehicles peaked in 2018 which basically means it’s unlikely that more cars with ICEs will be sold within a year in the future.

Most of the large automotive manufacturers are already adopting electrification as a way to improve the efficiency of their cars. Still, the internal combustion engine will continue to play a major role in the industry within the next at least two decades but, looking at what experts say, it’s probably safe to assume the ICE’s peak is now a thing of the past.

“We will probably see the peak of combustion engine car sales in 2018 based on global sales through October, plus estimates for November and December,”

Felipe Munoz, global automotive analyst for Jato Dynamics, told Financial Times.

As of January 2018, predictions were that the demand for ICE-powered cars will continue to grow until its peak in 2022. It turns out that the major drop in overall new car deliveries in the three largest regions in terms of sales, Europe, the U.S., and China, might have significantly changed the forecast.

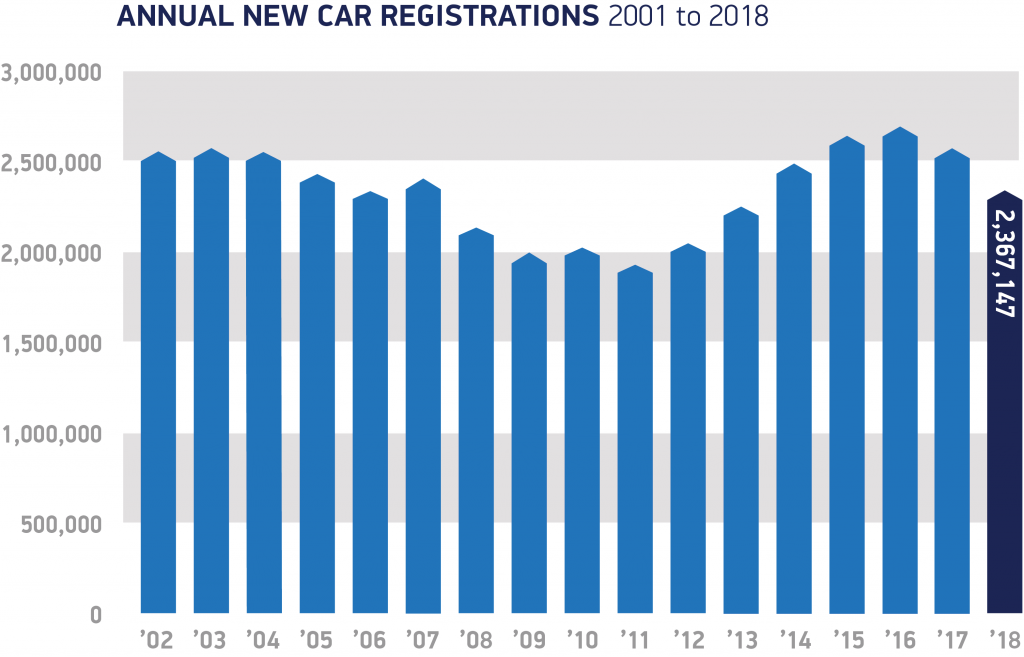

UK Car sales fall 7% Y on Y

We know from the SMMT that UK new car sales are dismal for 2018 and follow a grim 2017. The SMMT said new and more rigorous emissions testing rules created supply problems and a backlog of deliveries as car manufacturers suffered delays in getting their cars approved.

From 1 September 2018, all cars sold in the EU are subject to the Worldwide Harmonised Light Vehicle Test Procedure (WLTP), measuring all regulated emissions, as well as CO2 and fuel economy. These test are both more rigorous and should give real world data and need to be conducted for every model variant rather than a single example as previous test required. If you are BMW and need to test the new BMW 3 series you need to test every model with every engine configuration. So thats the Saloon in SE, Sport and M Sport with Plug In coming in July with a range of Petrol and Diesel engines. Grim work.

Last year, 2018 saw total UK sales of 2.37 million units a fall of 6.8%. The largest decline was in the diesel sector that fell 30% for the year. Anti-diesel rhetoric and negative fiscal measures took their toll, with December marking the 21st consecutive month of decline for the fuel type – despite new emissions tests showing diesels deliver in the real world. Growth in registrations of petrol (+8.7%) and alternatively fuelled vehicles (+20.9%) replaced some of the loss but not enough to offset the full shortfall as many diesel owners adopt a ‘wait and see’ approach, keeping hold of their older, more polluting vehicles for longer.

In the AFV sector, petrol electric hybrids remained the most popular choice, up +21.3% to 81,156 units. Plug-in hybrids (PHEVs) also recorded a strong uplift (+24.9%) over the year, though the figures suggest growth is slowing following the removal of the Government’s plug-in car grant for these vehicles in October.

Demand for PHEVs grew almost 30% in the first 10 months, but year on year increases fell to 3.1% and 8.7% in November and December respectively.

Pure electric cars, meanwhile, grew 13.8% in the year but, with just 15,474 registered, they still make up only 0.7% of the market. Given the reduction in government incentives, the pace of growth of plug-in cars is now falling significantly behind the EU average.

“When you look at 2018 since the summer, new car sales in all of the important markets are going down. Selling combustion engine cars to customers – this will not grow in the future,”

Axel Schmidt, global automotive lead for Accenture.

In 2019, global vehicle sales aren’t expected to decline as electric vehicles are expected to quadruple their market share to about 1.6 percent. Even if overall sales increase through the next 12 months, deliveries of ICE-powered vehicles will likely fall, say specialists.

GM hurting

The impact of falling unit sales can been seen in the response from the largest global players such as GM who recently announced it’s shuttering five production facilities and killing six vehicle platforms by the end of 2019 as it reallocates resources towards self-driving technologies and electric vehicles.

The announcements should come as a surprise to no one, as they echo a similar announcement made by Ford earlier this year that it will exit all car production other than Mustang within two years. EXIT ALL CARS – FORD!

Why the sudden attitude adjustment toward cars? Well, both firms cite a focus on trucks, SUVs, and crossovers.

North American car production hit 17.5 million vehicles in 2016 and dropped marginally to 17.2 million in 2017. Interesting, but perhaps not significant.

More telling are changes in driver behaviour. In North America, for example, fewer teens are getting driver’s licences. In 1983, 92 per cent of teens were licensed, while by 2014, that number had dropped to 77 per cent. In Germany, the number of new licences issued to drivers aged 17 to 25 has dropped by 300,000 over the last 10 years.

Fewer ICE cars on the road within a decade

We are moving from a do-it-yourself (DIY) transportation economy to a sharing, or do-it-for-me (DIFM), economy. Many of us won’t like it — I honestly like to drive — but the numbers and the technology are there.

As safety technologies improve and societal paradigms shift, this evolution will gather momentum. Based on the young driver statistics above, it seems reasonable to anticipate a reduction in cars per capita of 20 to 30 per cent in the next decade.

Unions at GM and Ford are justifiably unhappy, but they shouldn’t be surprised. It is quite possible that we have reached peak car in North America and Europe.

Companies that want to succeed in this new environment will need to be different and better in some way. If car volumes drop by 30 per cent over the next 10 years, there’d better be something special about the car company that hopes to survive, let alone prosper — like better technology, better comfort, or better service.

If current trends continue, we can anticipate more shutdown announcements — like GM’s — from car companies and parts suppliers, as there won’t be room for all of them.