New Bloomberg report on the use and deployment of Electric Buses makes interesting reading.

Produced by the @BloombergNEF and partners @c40cities the report paints a positive picture on the rapid adoption of electric buses especially in China.

See the full report

Worth a read and lots of graphics to help paint the picture.

Few key points and charts below.

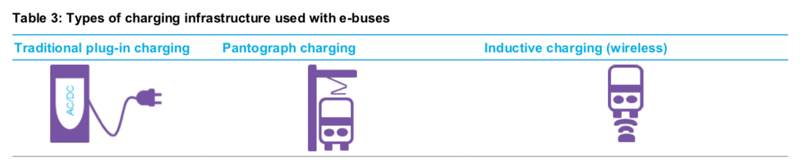

E-bus charging configurations

There are three main types of infrastructure for charging electric buses: plug-in systems, inductive charging and conductive pantograph (overhead) charging (Table 3). Traditional plug-in charging is the most common and the cheapest charging system in use with e-buses today. It offers a range of charging rates, from slow to rapid and it is provided by a range of companies, including Heliox, APT, Siemens and ABB.

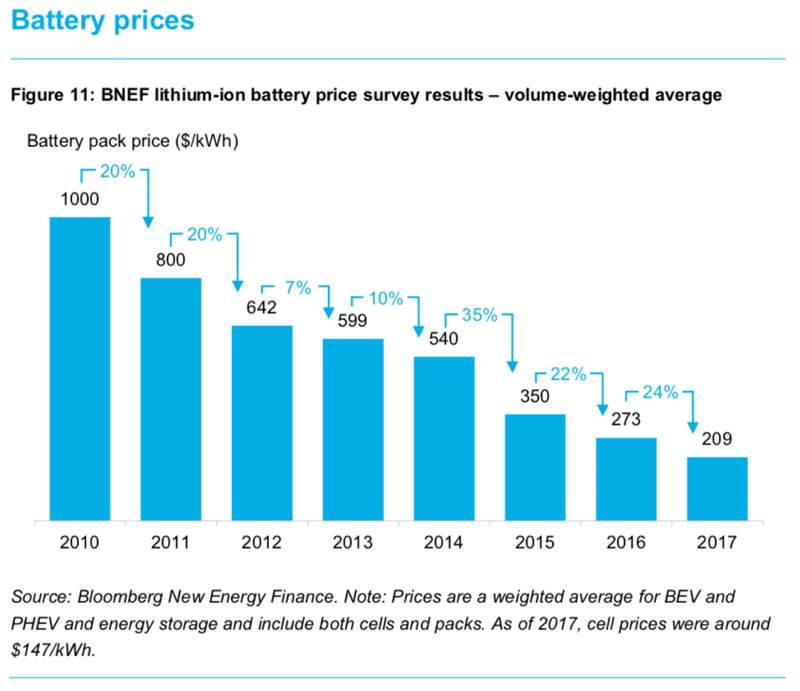

E-bus lithium-ion battery market review

The demand for lithium-ion batteries from electric vehicles – both e-buses and passenger EVs – is increasing. However, battery manufacturing capacity is increasing much faster than demand, which puts pressure on battery prices. As a result battery prices have fallen by 79% since 2010. The sensitivity of battery cycle and calendar life, and the challenges around predicting future battery life make warranties critical to e-buses. Since e-buses have only come to prominence in the last five years the true performance of their batteries may not yet be fully understood.